- ArticlesDesign

They quoted us £75,000, so we did it ourselves: the Cuckoo brand story

After being told by top London agencies it would cost upwards of £75,000 to develop our brand; we decided to embrace the challenge and keep it in-house.

We’re Cuckoo. We’re on a mission to make the internet frictionless. We’re one of the top-rated broadband companies on Trustpilot in the UK. And we’ve got a really awesome team.

We raised capital this year to help fulfil our mission. And while the best capital to raise is from happy customers, the next best is from investors. As a first-time founder/CEO, the process of getting investors to back us was new to me.

So here’s the guide I wish I’d had when I started. So if you’ve got a business plan, a bunch of people doing work, or even some paying customers, but you need more funds to help make it sing, then hopefully this guide will help you. Feedback appreciated!

The first step is to get into the right mindset. You know the market, the problem and the solution. And fundraising is a process of finding and converting people to your world view, fast.

Just as not every customer first looking at your product will buy it straight away, the same is true for investors. It’s a sales funnel! So try to take concepts you understand from sales and apply them to fundraising to develop your personal mindset.

I found that an ambush is a great analogy to think of for fundraising. You need to spend a lot of time preparing (recon), select the right moment (kill zone) and set metrics that trigger the raise (security team).

Why did it help me thinking of fundraising like an ambush? It got me in the right mindset. I’m choosing the location and timing of the operation and nudging the scales of chance in my favour!

You’ll need to have a think about who the best investors might be for your business. Not everyone will care about your market, or even see the opportunity that you see. You need to build up a sixth sense of what can pull someone in. Is it your team's background? Their own previous investing experience? Or even their own experience of the problem you’re trying to solve? Thankfully for us, most people have had an issue with their broadband provider…

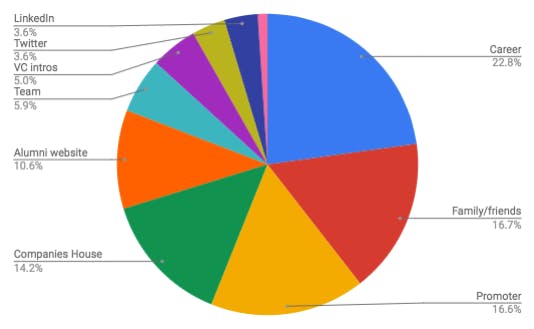

How you make the first contact is important, but not THAT important in my view. Just treat people like normal human beings and then move on! There’s a lot of debate about cold vs warm intros. If you make enough cold intros by yourself, then eventually the warm intros will follow.

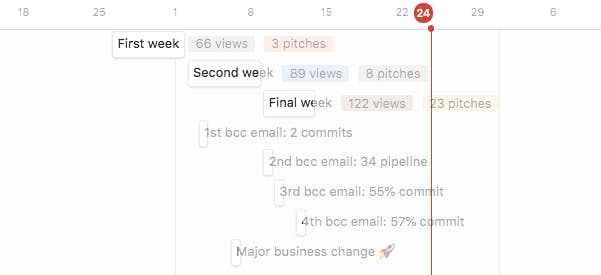

This is where you’ll spend most of your time and there are 5 rough stages.

1) The tease: An intro message that doesn’t overwhelm but teases a bigger thread of information. People are naturally interested. Play on that. Cold approaches should be:

2) The deck: Everyone needs this so you kinda need to provide it, often with a five bullets summary to set some context. Try using DocSend so you can track engagement. There’s nothing stopping you from iterating on the deck as the fundraising progresses.

3) The first meeting : This is where you want to wow investors with your story, how you first sought out this market, unit economics and future plans. Most investors ask the same questions, so again try and iterate on the answers.

4) The information dump: You usually then send prospective investors a whole host of information.

5) Follow-ups: This stage is dependent on each investor but can involve 2–3 more calls, references from current investors or even switching to the product! And remember to set up the deal, e.g. via Seedlegals.

We used the above approach, converting about 8% of those people who viewed our investor deck. That’s double the average global website conversion rate, so we must be doing something right.

⏰ 3 weeks

👀 277 deck views

📩 124 email convos

💬. 34 pitches

🤝. 21 investors

Just as broadband companies inject fear of losing out on cheap deals by putting time limits on broadband contract price deals, it works the same for investors! When you’re first raising funds this is really hard to do, since you can’t really inject urgency when there’s nothing changing in the business. It becomes much easier once you’re established, but in the meantime try to use external events (e.g. regulatory changes) to peg timings to.

Here’s a summary of what investors thought (both who invested and didn’t):

“Super strong branding/messaging. Clearly a super determined founder/great hussle. At this early stage, founder determination is critical. You strike me as somebody who will run through walls and won’t stop. Great regular updates. Very good ‘signal’. Willingness to take feedback. Even this feedback request is a great signal. Deck was very good. Very clear and well designed.” 🤩

“Very strong vision, well-drilled narrative and story presentation, humble accepting of advice” 🙂

“Perhaps I wish you were tackling something more interesting” 🙃

“I felt I had to dig around to get to key financials” 😬

“No startup experience vs lots of agency experience” 😔

“IMO you will always be valued off of EBITDA multiple not revenue which makes it hard to build a really big business” 😢

Well, a whole bunch of places. So the learning from this seems to be that you need to knock on a lot of people’s doors. Good luck! 🙏

After being told by top London agencies it would cost upwards of £75,000 to develop our brand; we decided to embrace the challenge and keep it in-house.

We’re making broadband simple, for good.